Since 2021, Funded Trading Plus has been providing traders with diverse funding models, including their signature one-phase evaluation for realistic capital acquisition opportunities in the forex market.

Scaling option available

News trading allowed

CEO is very public

No minimum or max trading days

EAS’s allowed

Weekend holding allowed

Refundable fee

Tight daily drawdown: 4%

Tight overall drawdown: 6%

Welcome to our detailed Funded Trading Plus review. In this deep-dive analysis, we cover all the things that matter to you as a trader. From evaluating funded challenge difficulty to exploring genuine trader testimonials and digging into the prop firms payouts, we cover all your questions.

to give you a clear picture of what awaits you in this review.

Refer to the table of contents below:

FTP stands out with its trading evaluation process. They offer a distinct system where traders, upon passing specific tests, can keep 90% of the profits they generate. The platform allows for starting with simulated funds, with the opportunity to progress towards managing up to $2,500,000. There’s a notable absence of monthly fees or stringent time restrictions, offering flexibility for traders. FTP encourages a thorough research approach to trading, catering to traders of various experiences.

The owner of Funded Trading Plus is Simon, who co-founded the company alongside Michael and James. Simon emphasizes the importance of transparency and good faith in the company’s operations, positioning these values as central to making FTP a leading firm in the industry. His vision for the company includes straightforward communication and a commitment to not engaging in practices that disadvantage traders. Through his active engagement with the community on platforms like Discord, Simon promotes a direct and honest dialogue, encouraging traders to make informed decisions about their affiliation with FTP

Achieving funding with Funded Trading Plus can be realistic, yet it presents a challenge with its 4% daily and 6% total drawdown limits. These thresholds require solid risk management and may be tight for some trading strategies. However, for scalpers who typically make quick, small trades and are used to strict risk controls, these targets are attainable. The key is disciplined trading and a strong handle on risk to navigate the program’s requirements successfully. The program’s design, which caters to various trading styles, still makes FTP a viable option for those who can operate within these tight parameters.

Barish from India recounts his experience with Funded Trading Plus, where he successfully withdrew $26,000. He contrasts this with his previous disappointing encounters with other prop firms. The interview with the FTP podcast host seems authentic and gives no indication of fabrication, lending credibility to Barish’s account and highlighting FTP’s potential for real-world trading success.

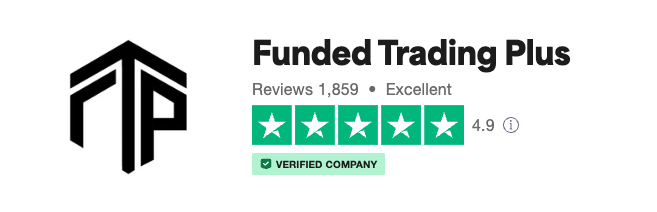

Funded Trading Plus boasts a high Trustpilot rating of 4.9, reflecting positive feedback from many users who seem to be authentic traders sharing genuine experiences. Reviews highlight the prop firm’s responsive customer service. However, amidst the praise, there are critical reviews that question the clarity of the rules and withdrawal options, indicating some areas for potential improvement. While most feedback appears legitimate, as with many review aggregators, there are instances where some reviews might raise doubts about their authenticity, although these seem to be in the minority.

Funded Trading Plus offers a range of funding options tailored to diverse trader needs. Here’s a snapshot of their offerings:

Experienced Trader Program: Tailored for seasoned traders, offering a single-phase evaluation, an 80/20 profit split (up to 90/10), and a 10% profit target. Drawdowns are capped at 6% relative and 4% daily, with account sizes ranging from $12,500 to $200,000 and no minimum trading days required.

Two Phase Program: Aimed at providing flexibility, this program has two phases with a profit target of 8% for Phase 1 and 5% for Phase 2. Drawdown limits are set at 8% relative and 4% daily, catering to account sizes from $25,000 to $200,000. Notably, it provides quicker access to capital without a mandatory evaluation phase, and has similar flexibility in trading days.

Instant Funding: This premier option offers instant funding with no evaluation phase. The profit split starts at 80/20 and can go up to 90/10. It allows for a 6% relative drawdown with no maximum daily limit, suitable for accounts from $5,000 to $100,000. This program affords the most funding with the least restrictions, with no minimum trading days, allowing traders to scale their accounts as they succeed.

The challenge rules for Funded Trading Plus are crafted to ensure fair play and risk management:

Trading Platforms: Only MT4 or MT5 are supported. Traders may use analysis from NinjaTrader or Tradestation but must execute trades on FTP’s platforms.

Account Limits: Traders may hold multiple evaluation accounts but are limited to two funded accounts at any one time, with a maximum initial funding of $400,000 across all accounts.

Account Resets: Traders have the option to reset their account if they fail an evaluation, subject to varying fees.

Tax Obligations: Traders are classified as independent contractors and are responsible for reporting their earnings to their respective tax authorities.

Contracts: All traders must sign a service agreement to be allocated an “FT+ trader account.

Copy Trading: Copy trading is not allowed across FTP accounts, including holding the same positions on the same market at the same time.

One Account per Name: Traders cannot have more than one account under different names; the name on the account must match the contract and identity documents.

Risk Management: Trades are assessed for proper risk management, and traders may be disqualified if they do not meet the standards.

Expert Advisors (EAs): EAs are permitted but must be approved by FTP, and they must not engage in prohibited trading methods like arbitrage.

$200,000

Select your preferred account size and start trading

BestEverForex © All Rights Reserved 2023