Trade The Pool, under the experienced leadership of CEO Gil Ben Hur—also renowned for his association with ‘The 5%ers’—is carving out a unique niche in the prop trading industry

Experienced team behind them

Pump and dump feature

Strong trust rating of 4.3

CEO is public

Very tight drawdown 4%

30 trades required

Welcome to our detailed Trade The Pool review. In this deep-dive analysis, we cover all the things that matter to you as a trader. From evaluating funded challenge difficulty to exploring genuine trader testimonials and digging into the prop firms payouts, we cover all your questions.

to give you a clear picture of what awaits you in this review.

Refer to the table of contents below:

Trade The Pool, often referred to as TTP, is a relatively new prop trading firm which is quickly gaining popularity in the industry. TTP distinguishes itself with its unique funding models. Their goal is to provide an accessible platform for traders to engage with global stock markets while maintaining clear and concise funding parameters. The company’s establishment has ties to the trusted prop firm ‘The 5%ers’, with the founder of the latter also being the driving force behind Trade The Pool.

TTP offers varying levels of buying power to traders, with funding opportunities going up to $260,000 depending on the account type. The company’s funding model revolves around a transparent evaluation process. Prospective traders are required to undergo this evaluation, which primarily focuses on completing a predetermined number of trades within a set timeframe. Essential metrics, such as daily loss limits, are instrumental in defining the associated profit targets and the maximum allowable drawdown for traders. By setting these guidelines, TTP aims to establish a transparent and structured trading environment for its users.

The driving force behind Trade The Pool is Gil Ben Hur. Known in trading circles for his strategic insight and experience, Ben Hur is not new to the world of prop trading. Prior to establishing Trade The Pool, he founded ‘The 5%ers’, a respected prop firm that has garnered trust and credibility within the trading community. With Trade The Pool, Ben Hur seeks to extend his vision and provide innovative solutions to traders, fostering a platform that emphasizes both accessibility and skill development. His history with ‘The 5%ers’ stands testament to his commitment to the industry and the trustworthiness of his ventures. Under Ben Hur’s leadership, Trade The Pool promises to offer a transparent, structured, and supportive environment for traders of all levels.

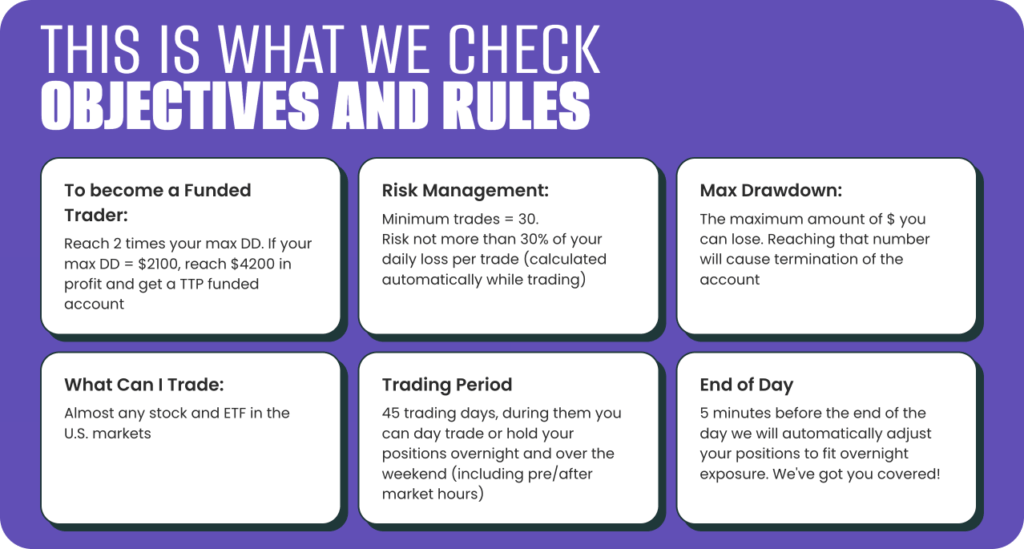

Getting funded with Trade The Pool hinges on meeting their set evaluation criteria. Traders are tasked with completing 30 trades in a 45 day period which is challenging, while sticking to daily loss limits ( which is 4% in some cases which is also challenging ) and hitting profit targets within a given period. The process aims to support traders who exhibit consistency and good risk management.

Is it achievable? For well-prepared and strategic traders, yes. However, it’s not without its challenges, especially for newcomers. Trade The Pool looks to fund traders showcasing potential and skill. While funding is within reach, it demands dedication, a keen understanding of the firm’s guidelines, and self-assessment of one’s trading abilities.

During our research, we came across numerous videos and testimonials, many originating from Trade The Pool’s official YouTube channel. Highlighted below is a feature video where a funded trader, Domingo, shares his journey and experience with Trade The Pool.

Trade the pool have a strong Trust pilot rating of 4.3 which is a strong score in the industry, many reviews mention how they got funded while others point out the good customer service.

Trade The Pool offers traders diverse funding options to cater to different needs and preferences. These options are specifically designed to provide traders with various levels of buying power and distinct advantages.

Trade The Pool introduces this innovative mechanism to adjust a trader’s daily loss allowance dynamically.

In essence, the “Pump and Dump” feature dynamically scales a trader’s risk parameters based on their performance, striking a balance between rewarding success and mitigating prolonged downturns.

Mini Buying Power: Ideal for novices, this account offers a buying power of $20,000. With a cost of $97, it provides a balanced profit split, allowing traders a steady growth opportunity.

Super Buying Power: Aimed at intermediate traders, this account provides $80,000 in buying power for a fee of $300

Extra Buying Power: For experienced traders aiming for broader market maneuvers, this account boosts the buying power to $160,000 at a fee of $475.

Ultimate Buying Power: Crafted for the most seasoned traders, it furnishes a robust $260,000 in buying power at a cost of $1240, accompanying a more favorable profit-sharing ratio.

Trade The Pool, like many proprietary trading firms, sets forth specific trading rules to ensure the proper management of its funds and to maintain the sustainability of its unique funding model. These rules are designed to strike a balance between providing traders with flexibility and safeguarding the company’s capital. By understanding and adhering to these guidelines, traders can effectively navigate the platform and optimize their trading potential.

Daily Loss Limit: Traders have a predetermined daily loss threshold which they should not exceed.

Maximum Exposure: The total open positions a trader can have at any given time is capped.

Holding Overnight: Depending on the account type, there could be rules regarding holding positions overnight.

Instrument Restrictions: Not all trading instruments might be available, or there could be limits on trading certain assets.

Use of EAs: The use of Expert Advisors or automated trading bots might be restricted or have guidelines.

Pump and Dump: Dynamic adjustment feature that modifies a trader’s daily loss allowance based on their performance.30

Minimum trades required: users must open at least 30 trades during the 45 day challenge period

$260,000

Select your preferred account size and start trading

BestEverForex © All Rights Reserved 2023